‘Imagine. A financial institution that lets everybody profit. Now that’s an idea I can live with.’ – Vancity Billboard, Vancouver, July 2012

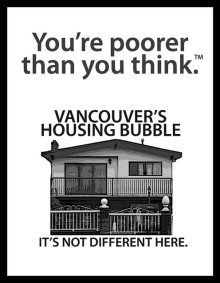

“A brief recount of recent history is necessary for understanding why and how the local government under Vision Vancouver can be expected to aim towards re-mortgaging the housing crisis, deferring the current crisis of value underlying overinflated housing assets citywide. When the market crashed in 2008, many saw an opportunity for the city to meet its promised housing goals, including its promise to take actual concrete measures to end homelessness. After years of land speculation and high prices created by unprecedented consumer debt, properties finally started showing signs of affordability, with housing activists calling on the municipal government to buy newly-priced lots throughout the city.

In effect the opposite occurred, with sections of the property elite buying up land from the province in private deals, like at Little Mountain in 2009, or selling land back to the government at inflated pre-crash levels, like the land trading of Robert Wilson, who bought dozens of buildings and sold them back to the public. Fundamentally, Wilson and Holborn’s extraction of public funds and assets represents the spirit of the broader post-2008 period.”

…

“Looking back on the past half-decade, what stands out is that since the onset of the financial crisis of 2008, no effort has been made in policy and elite circles to re-evaluate the fundamental contradictions of state-backed housing privatization, despite the rampant inequalities produced by Vancouver’s real-estate market, and despite the volatility of that system. The market, towering over an exploitative rent-extraction economy, has only been the recipient of ever-new supports from the neoliberal state. The only decisive action taken by politicians has been made to add more layers of finance to the teetering system of debt and precarity. The recent experience in Vancouver has shown that while elites continue to prolong the system and extract super-profits, radical change can only come from below. Only a movement led by renters will be capable of taking action to halt the circuits of the exploitative real-estate economy and replace it with something new.”

…

– excerpts from ‘Re-financing the housing bubble: Strategies of the neoliberal state’, Nathan Crompton, rabble.ca, 20 Jul 2012 [hat-tips to ‘joe_blown_away_by_high_housing_costs’ and Jeff Murdock]

—

“My biggest complaint with the article is placing onus on Vision Vancouver for perpetuating the bubble when it’s the nature of the City’s finances, not the political stripe of council, that’s the problem. Ultimately cities derive revenue from permits and other real-estate-related activities and, if that is not present, either need to increase revenues in other areas or cut back. …

So at the local level, because of how the tax base is matched to the expenses, regardless of who’s in power, there will be pressure to kowtow to the real estate industry to keep revenues flush. And it’s not some “neoliberal” trend in my view, it’s what the populace votes for…”

– from a comment by jesse, VREAA, 20 Jul 2012

—

Our thoughts:

As a speculative mania develops and takes hold, more and more individuals and institutions in a society become aligned in their interest to perpetuate the bubble. This occurs on all levels, from the citizen to the federal. Home-owners, RE investors, landlords, contractors, developers, realtors, universities, credit unions, banks, municipal government, provincial government, central banks, federal government…

The entities are co-opted, not by some plan, but rather because all interests become aligned in a dependence on ever increasing prices, and the debt financing necessary to keep that going, and the temporary artificial easy ‘wealth’ that results. Ever expanding borrowed funds being spent into the economy certainly seems better than having to generate genuine wealth from true productivity; and it seems good to the naive, while it lasts.

It is crucial to realize that the majority of individuals and institutions become aligned in this interest, regardless of political stripe.

In the mature stage of a speculative mania, the vast majority of citizens and institutions are heavily dependent on the bubble continuing, and almost all those in positions of political power will have been thoroughly co-opted. This is a market effect. This is also why bubbles are never, ever legislated away. The majority always votes to shore up the mania, to perpetuate the bubble; any dissenting voices will be voted down; any protesters ejected.

Government intervention, from the civic to the federal, can extend the life of bubbles, but cannot dismantle them safely. This is not an ideological, or a pessimistic observation, but one made based on mathematic law and knowledge of market dynamics. Like a chain-letter or a Ponzi scheme or a raging forest fire, the engine runs out of fuel, eventually.

…

Of course, there will be all sorts of flavours and differences in the finer points of this process, so it is arguably of value to discuss how exactly local government is choosing to perpetuate the bubble. In this regard Nathan Crompton’s article is of interest. We respectfully submit, however, that the large overarching picture is far, far more important, and that differences in local approaches will pale into insignificance in the face of the broad implications of a collapsing speculative bubble. After the dust settles, the exact details of local policy will again become important.

…

– vreaa