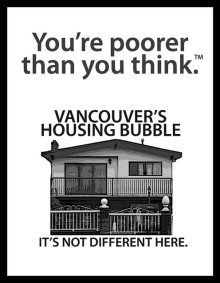

Gambling chit or home?

“Average prices in British Columbia are forecast to grow 2.2 per cent this year and remain unchanged in 2018, CREA said.”

– from ‘CREA cuts 2017/2018 outlook for home sales in Canada’, G&M, 15 Sep 2017

“Paradise, meet purgatory: Average Metro earner reaps $72,000 a year, pays $1.4 million for a home”

– headline from The Province, 14 Sep 2017 [hat-tip to brian]

In a market that has come to expect 7% growth p.a. (with peaks to 25% p.a. being seen as normal) a substantial period of flat price growth will feel odd; almost like a contraction.

The eternal question for Vancouver RE is: “Will people be willing to step up and buy if prices are not rising?”

This is the essence of our longstanding belief that “all buyers are speculators” — we believe that people buy at these price levels not for utility, but largely for anticipated price growth. We believe they certainly would not be buying without anticipated price growth.

So, what will happen to Vancouver RE prices if prices stop rising? What happens if the speculative component of buying disappears?

We believe that this will result in prices dropping to a level that reflects the value of the utility of the property, and that currently such values are far, far below asking prices.

It’s too early to say, but it does seem that prices in some sectors of the market have stagnated.

Talk at the corner of Rumour & Grapevine is of $3M, $4M, $4M+ – ask-price homes getting no interest whatsoever, and being removed from market. Also of condos over $1M getting little interest. If the supply of eager buyers is limitless, why is this happening?

Perhaps that house isn’t ‘worth’ $4.5M if there is no longer a chance of it being ‘worth’ $5.5M next year. Perhaps its actually ‘worth’ closer to $1.5M (a price that would already value it richly for its actual utility), or even (preposterously!) $1M if we consider local incomes and historic norms. [This argument can be scaled for all levels of the market].

– vreaa

Postscript anecdote:

“I’ve started my active research in the detached market in my area. Inquired today about a detached 3br house in Langley (BC) nice neighbourhood, south-facing yard. Last Saturday we missed the open house, so I called the following Wednesday and inquired if they had taken any offers. “They listed after the long weekend and were going to take offers on the Tuesday but received no offers.” To which I replied “So do you think we could offer below asking, if we were interested?” He replied “Oh yea, definitely.”

– from PupPatrol 09.15.17 at 6:04 pm at greaterfool.com