The average price of a Canadian home sold in January was $470,253, just 0.2 per cent more than the same month a year earlier.

The Canadian Real Estate Association reported Wednesday that sales were down by 1.3 per cent during the month, to the second-lowest monthly level since the fall of 2015.

New government rules designed to crack down on speculation in the mortgage market came into effect in October and January’s numbers suggest they appear to be working.

“Canadian homebuyers face some challenges this year, including new mortgage rules that make it harder to qualify for a mortgage and regulatory changes that will push up mortgage financing costs,” CREA president Cliff Iverson said in a release.

“It will take some time to gauge the extent to which these challenges will weigh on home buyers in different housing markets across Canada.”

– ‘Average Canadian house price barely increased in past 12 months’, CBC 15 Feb 2017

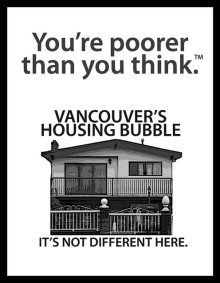

Longtime (and long-suffering) readers will recall that our premise has always been that, in markets such as Vancouver, people have overextended themselves to buy homes at prices far above fundamental value because they anticipate ongoing outsized future price increases. This is why we have called all buyers ‘speculators’. A significant price stall or pullback will test this hypothesis. Will buyers still be eager to overextend with the prospect of ‘barely increasing’ prices in future?

Speculators are almost all momentum buyers; they hate assets that are falling in price.

– vreaa