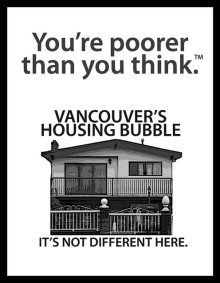

Some are frantically calling the bottom in the Vancouver RE market, in word or in deed. This from eyesthebye on 2009 Feb Wed 25, 6:05pm & 10:21pm who seems to believe that the market can’t possibly deteriorate further from here –

“He’s saying the price of a single detached in Vancouver should be 493,000? I just bought a place – a character 1 and half story at over 600K and I had to line up for it – in fact, every decent home I looked at was sold in the first week for high 500’s to 700K. I’ve even see substandard locations sell for 500K in the first day offered. If you’re in the market for a single detached expect to pay 600K for a decent place. The 493K will not happen in my lifetime.”

“Buying a decent house in Vancouver for under 500K is a pipe dream. Trust me, I’ve just been through it – searched for a HOUSE for six months and every time there was a decent 1.5 or 2 storey character house for under 700K it was gone. Go look for yourselves – mls is littered with Vancouver specials and bungalows – nobody wants them yet they will still sell for minimum 500K. Anyone who doesn’t believe this can continue to live in their rented apartment or owned condo”

UPDATE: The above poster later revealed “I have a construction trade too…this is not a secret.” (RE Talks 11 Dec 2009 4:31 pm)