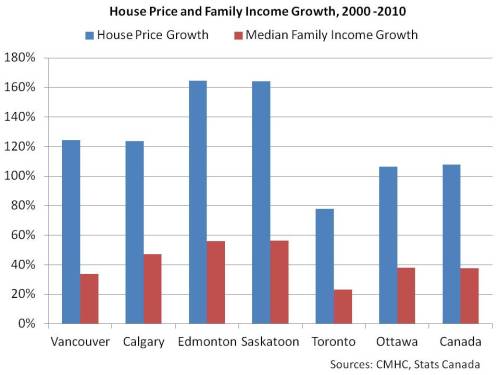

– chart care of Kevin at saskatoonhousingbubble, 15 Jan 2013. [Thank you Kevin.]

A nation-wide bubble in home prices, driven by cheap financing and local speculators.

– vreaa

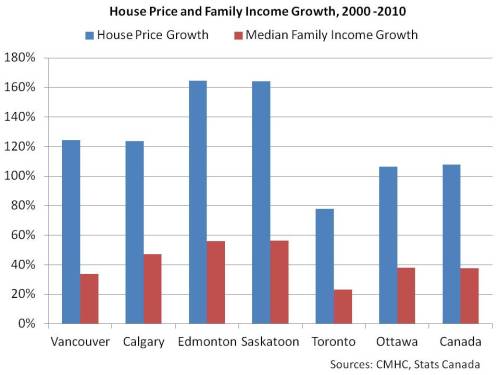

– chart care of Kevin at saskatoonhousingbubble, 15 Jan 2013. [Thank you Kevin.]

A nation-wide bubble in home prices, driven by cheap financing and local speculators.

– vreaa

Couple of RE stories from this week.

First concerning a fellow who confided in me that his strata fee is going up 75% and wanting to know if there was something he could do about it. Told him I felt bad for him but strata passes the budget.

Second fellow purchased a pre-sale about 4 years ago trying to bank on the Olympics. I haven’t seen him in years but recently inquired about the condo. He flatly told me it turned out be a huge financial loss. I didn’t dare ask him the exact amount.

I just spoke with a friend last night. They moved into a very large condo building (246 units) in Joyce around four years ago. It is 14 years old. There was a sign in the elevator about a strata meeting to discuss how to fund upcoming “piping” work and “building envelope project”. I asked my friend about it, and she said that they had raised strata fees every year since they moved in. The highest raise was last year, for 10%. In total, since they moved in, the rate has increased by around 30%. Now comes the next big raise to pay for all this upcoming maintenance, or… maybe even their first special assessment. What a happy, special milestone on the path to house ownership! Sniff. It’s sure to bring tears to the eyes. Not an occasion to be missed.

It was a nice reminder of how little control people who buy condos have over their financial lives. The anti-renting propaganda often rails about how renters live subject to the whims of their landlord, and claims that when you own you are the master of your destiny. It seems completely the opposite from where I’m standing, in a warm, clean, well maintained building with predictable monthly outlays and no chance of lump sum demands…. and no downside risk.

(Caveat: I rent from a professionally managed building after going through 8 1/2 years in three amateur landlords’ SFHs. I cannot emphasize how superior a professionally managed, purpose built rental is to most amateur landlords offerings. I can’t even begin to fathom how superior it must be to an “accidental landlord”‘s service.)

I agree, it’s very nice to know that as a renter, you are secure in that you will never be demanded to pay what can be a huge sum for a special assessment. And your rent can never be raised more than the amount allowed every year. I’m currently renting from a private landlord (not accidental), and they haven’t raised the rent in the three years we’ve been here. I rented from a purpose built rental before and wasn’t exactly happy with it-they raised the rent every single year by the maximum (so if I’d stayed there a few years, my rent would have far exceeded the market rent for the area), and when I moved out they automatically deducted $150 for cleaning the blinds-really pissed me off! I say it’s really hit or miss with landlords and rentals-there are good and bad, you never really know what you’re getting into and you have to do your due diligence on the landlord as well, not just checking out the property.

oh, and when interest rates rise, you won’t face another huge monthly jump, too.

I am a little worried by what you say about the annual increases in rent. Was the rental market hot at that time? When we moved in the building had 3 just-renovated 2 bedroom units to choose from and some 1 bedroom. There has hardly been a time when one unit has not been vacant since we moved in. For that reason I cannot imagine the rent increasing by the maximum allowed too many times, or the tenants could surely find alternative offerings. I should ask some of the long term residents… though even the fact that there are very long term residents here suggests contentment.

However, an unscrupulous management policy could be to raise in the knowledge that people will tolerate it for a few years since moving is so troublesome and costly. That policy would have to be underpinned with the certainty that they can refill the apartment every time with no vacancy period.

That’s my building. I rent the best unit in that building for the last 13 years. There is a unit in that building as #1 on Vancouver Price Drop last week. Here is my Facebook update this morning:

Update January 17, 2013

2013 Assessment: $316,000

Total Rent Collected (annually): $12,000

Property Taxes for 2013: $1204.43

Strata Fees for 2013: $250/month = $3000

Assumed Marginal Tax Rate on Rental Income: 30%

Assumed Outstanding Mortgage: $0

Assumed Outstanding Mortgage Interest: $0

Assumed Maintenance: $0

Total Return for 2013: ($12000 – $1204.43 – $3000) * 0.7 / $316,000 = 1.7%

Average Inflation of Canada in 2012: 1.58%

Assuming my landlord has no mortgage interest expense, they are barely able to keep their invested money from devaluing against inflation. I appreciate them taking this risk and letting me free up my capital for a diversified investment account. It’s interesting that the landlords could take their entire $316,000 (if they could get that on an immediate sale) and put it in any of the following High Interest Savings Accounts and they would make more money than owning and renting out this home, risk free.

AcceleRate Financial, 2.00%

Achieva Financial, 2.00%

Ally High Interest Savings, 1.80%

Bridgewater Bank Smart eSavings Account, 1.85%

Canadian Direct Financial KeyRate Savings Account, 1.90%

Hubert Financial Happy Savings Account, 1.85%

MAXA Financial MAXA Savings, 2.00%

Outlook Financial High Interest Savings Account, 1.95%

Peoples Trust Peoples Choice e-Savings Account, 1.90%

I couldn’t find it on vancouverpricedrop. Can you give a link if it’s not too inconvenient? Thank you.

If your landlord bought 13 years ago, they have made a far better return than just rental yield…. if they sell and collect soon!

Richond and Vancouver?

Nice work again Kevin. The charts tell a story that mere words cannot convey. This is visual proof of the high prices at play relative to income and tells us in no uncertain terms how real estate is actually impoverishing buyers by eating into their potential savings.

This is the most likely case. Another scary scenario is that the HAM/Drug Money/Everyone wants to live here story is true and nearly no one with “normal” sources of income is actually buying.

That would be more of a concern if it wasn’t for the fact that every city has outpaced income growth by a huge margin. Drug or HAM money in YVR could be an explanation but not in Edmonton, Saskatoon, Winnipeg etc. as well. In fact, because YVR has been outpaced by many other cities I’d argue the drug/HAM factor is even less important than supposed in Vancouver. If it were a significant factor you’d expect YVR proce growth to outpace other cities.

I heard Saskatoon is running out of land.

Great chart. Interesting to note that overall income growth of nearly 3.5% (annual rate) 2000-2010 seems to be outstripping CPI inflation over the same time period as well. Maybe a bit of an income bubble here in Canada too, especially on the prairies.

Or, CPI is a manipulated lie and not a real measure of inflation.

http://www.rateinflation.com/inflation-rate/canada-historical-inflation-rate?start-year=2000&end-year=2010

Cyril -> It’s fascinating that income has been increasing at 3.5%. We’ll be posting a discussion of RE trend lines by Froogle Scott next week, where 3.5% (or thereabouts) features large. Co-incidence? Perhaps.

[Actually, 3.5% real, not absolute; so somewhat different. No matter, won’t let that get in the way of a nice co-incidence. 😉 ]

There is no doubt that any economy which has experienced a huge run up in house prices has also experienced larger wage increases in industries related to housing. Without the data, one can only guess how much the credit bubble has inflated certain wages throughout the economy.

Vreaa,

I’ll be doing a big super post on Vancouver’s real estate bubble in the next week or so. I’ll let you know when it’s done I’m currently finishing up a 2 part post on Calgary.

Kevin -> Good point re wages being artificially pumped by debt spending related to RE. What proportion of the wage growth has this contributed? Possibly more than 100% of it!

..

We look forward to your Vancouver RE bubble post, we’ll link it here, obviously.

You wouldn’t have a link to the post on Calgary? I lived there for a while and would like to see commentary on the real estate market there.

http://saskatoonhousingbubble.blogspot.ca/

Yesterday I took a cab in downtown Vancouver. The driver went on the phone inquiring about buying a farm property in Washington, so I heard half the conversation. He asked whether he could get a mortgage as a Canadian citizen (he was seeking $1 million). He said the prices were half what they would be in Canada.

Maybe we shouldn’t be tipping so much. I’m a professional and I sure can’t afford a million-dollar foreign investment property.

A lot of service industry is no longer down on their luck, recent immigrants, students, or single mom trying to make ends meet. I have heard conceirge at downtown condo buildings getting $100K+ in XMas gifts/tip every year!!!! That’s $100K+ tax free money! Waitresses at Joey’s, Cactus Club probably full down $100K+ full time equivalent income as well. The true sad hard to make ends meet people are really the middle class income earners who has to report all their income and no tax breaks. But we are trapped in this society where if you don’t tip certain industry that not only makes more than you and dodges, then you are cheap and immoral.

The cab driver is probably a doctor.

I know waitresses at Cactus Club and a bunch of other places. They do not pull down $100K full time equivalent net income. Yeah, tips are good, but unless they’re also dealing coke on the side… they’re not THAT good.

Absinthe, I agree. I knew someone who was a Southern California grade blonde babe who waited tables at places like cactus club. She made very good money for someone still in undergrad, especially considering how few hours she worked. But the wage and tips was not $100K full time equivalent net income no matter how flattering her outfit or flirtatious comments were.

He has 12 relatives living with him all collecting welfare and working under the table tax free. Has a great support system to scream racism the moment anyone in the media points out the truth. And politicians in his collective back pocket counting on the “group vote” to never say a word. welcome to Canada.

Bob,

Oh so true.

“I’ll just tell them I ran out of printer paper for receipts.” – Muhammad Khan

[TheDependent] – Welcome To TaxiLand

…”The going rate for a share at Yellow Cab, by far the city’s largest taxi company, is somewhat of a mystery; Khan says $800,000 is a good estimate for a full cab, split roughly down the middle between day and night shifts at some $400,000 apiece. Hoping to verify Khan’s estimate, I placed calls to a lengthy list of sellers (their numbers lifted from the Yellow Cab board), and though very few were willing to talk, those who did gave a large spread of costs, with the cheapest day shift I could find selling for $250,000, and the more lucrative night shifts for as much as $500,000.

Given the staggering jump in value, it’s little surprise that many shareholders choose not to drive the cabs themselves, but instead chop each licence into the two aforementioned 12-hour shifts, then offer up the rights to those shifts as one-year leases to drivers who can’t afford the capital investment to buy their own.”…

http://tinyurl.com/8yh5dgz

[NoteToEd: One summer between semesters, a long time ago in a galaxy far far away, ‘Nem’ hustled BurnaBonianGrannies for nickle tips in his brilliant orange 20ft. FordCustom500 featuring 429cu” of V8 ‘juice’ – rather like this: http://tinyurl.com/anquqkc ]

….“I’d love to be a licence holder,” I fire between the pet names. With a lease income of some $4,500 a month on an $800,000-investment, this seems a better deal than real estate. And that’s saying something in Vancouver. But perhaps more importantly, how the hell can drivers afford these lease amounts?”…..

…abstracted from the article above…

pffft! … http://tinyurl.com/bkgkmz8

So “We’re not richer than we think”.

The post is from Saskatchewan Housing bubble. This is the same as chipmunk’s fart

We are up to 20% off still being within the bounds of a “healthy correction” and not a “crash.” I expect this rationalizing to continue to at least 50% off.

“Even most bank economists believe Canadian housing is overpriced somewhere in the range of 10% to 20%, perhaps more so for the hottest condo markets. That’s manageable as long as interest rates and unemployment remain low, says Doug Porter, deputy chief economist at BMO Capital Markets. ”

http://www.canadianbusiness.com/economy/how-low-will-house-prices-go/

They just say what has already happened. Last spring they predicted modest rises. By summer they said we’ll see a flat market over the next few years. In the fall they were saying around a 10% correction might be overdue, now its 10%-20%.

The public statements from economists are meaningless. They do not have the freedom to say what they think.

Regarding strata fees. I am on our strata council, a townhouse complex of 35 units in west side vancouver. About half were bough by investors, probably HAM, or holding company for the developer who are not paying their fees. Our strata corporation is going broke! We will be placing a lien on the delinquent properties so they can’t sell but it shows that these investors really do not care about how their property is managed. Oh well, when they try to sell, they won’t be able to until they pay back their fees with interest.

wow!

Yeah….who needs to worry about the bank repossessing when your neighbors will put you in debtors prison for failure to meet the levies they set, Brian.

So the next question is where do strata fee liens rank? As I recall, in some US States they ranked ahead of other debt but behind taxes, meaning they’d get paid if the first mortgage holder foreclosed, but in others they ranked in as filed order, so they wouldn’t unless the owner had equity.

This is the part of the cycle where such little details start to matter.

I dunno if people aren’t paying because they can’t afford to though. I suspect not. Fees are only about 300-400 dollars per month. Many units are empty and have been sitting on the market for over a year. There has only been one sale, January 2012 for 1.28m. Rest are still asking for 1.3-1.5m. I think people just don’t care and are probably not even in the country. Essentially, at the last strata meeting, only 7 owners showed up, and really only 3 of us can speak English to any reasonable degree. I guess they just don’t want to lose any money, hence the static prices.

As for me, I’m a real estate bear forced into buying by the wife and family. Not that I really care, as I can survive rate increases up to even 20%. I already have 50% equity in this house. I’m just bitter at the lost opportunity costs, but I’m delaying paying the mortgage as long as rates are low, and putting money in better medium and long term investments.

Seven would not be a quorum.

A couple of offshore Germans can have up to 70 proxies.

Happens all the time.

Advice: Stay away from Stratas.

A few owners call the shots.

I just remembered a conversation overheard in the park last summer. It was a half-anecdote, so I never submitted it at the time… but I recently found myself thinking of the fate of the protagonists.

I only caught snatches of it, but the gist was that a guy in his thirties was answering questions about his tear down build and flips. He was saying how they keep the plans the same and re-use them over and over, and build the same style of house with same decorations each time… this keeps the building costs lower. “You make money when you do it like that” he said in response to questions from his companions. “Keep it simple, not too fancy, and just use the same designs and materials.” He spoke like he had a lot of experience in building houses, and seemed a very confident young man. I could sense a very keen interest in his job as well as admiration from his companions.

Just wonder if things are any different now.

Whoa! Some people haven’t heard of the contraction in RE – I’m a renter in a SFH in Marpole, and just had a developer at the door asking me if I owned and would like to sell. When I said I was a renter, he asked me if the owners lived in the basement. (They don’t.)

This little neighbourhood has seen a lot of tear-down and new development in the 3.5 years we’ve been here, usually turning a single into one of those awful boomboxes that have basement suites, but look like they’ve been made of tape and cardboard. There are a few that have been sitting for quite some time but it always seems the new inventory moved slowly in this area, anyway. So maybe the developers out here think it’s just a matter of waiting.

So maybe this developer will get in touch with our landlord and we’ll be out on our butts. Sigh. I suppose the good thing would be a month free rent. This house isn’t being cared for, and tho’ I love it dearly, I can see that it would be an ideal time to unload it.

Hey gang, check this out from ” Whispers from the edge..”.”

Canadian Business Magazine: Front page: How low will house prices go”..very interesting read!!

I can’t get Whispers. Can you just tell me what it said in short form.

Still not able to access? wtf

This article is being highlighted: http://www.canadianbusiness.com/economy/how-low-will-house-prices-go/#

I blame the Chinese. They block far too many good sites. Keeps the locals in the dark like a bunch of mushrooms. Thanks for the link by the way. Awesome article and fairly accurate in its analysis of what is yet to come. Anyone deeply in debt with a mortgage right now should be losing sleep. We have a long steep decline that now lies ahead of us and it will be a setback for untold numbers of Canadian families who could not understand the risks that a low rate environment and easy credit combined would engender for their family finances.

Thanks…..good link. The “Great Bear Argument” appears to have gone mainstream….

The article ends with “When it turns, it turns very fast”.

I see the turn just ahead of us.

Average price for a home in Canada has been falling for months. House prices in overheated markets will continue to tumble…Speculators are worried as well as develpoers in the spec condo markets in Toronto and Van

Miami North!!

with mold and passive aggressive cliques

so, i see that by inflating housing beyond the means of the mob, it affects their ability to breed! You are just walking up to our methods!