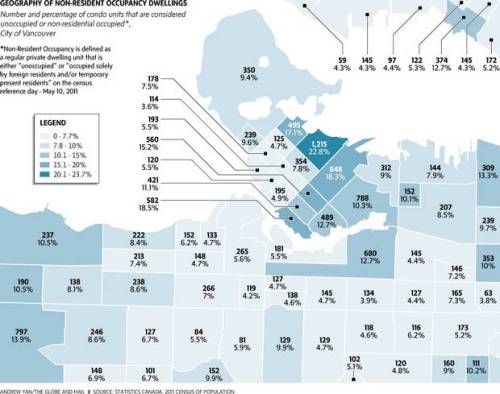

UBC planner Andrew Yan’s research raises questions about whether the city is turning into a high-end resort or a haven for offshore investment. [image from Globe and Mail]

“Nearly a quarter of condos in Vancouver are empty or occupied by non-residents in some dense areas of downtown, a signal that investors play a significant role in the city’s housing market.

And the city overall has a much higher rate of empty apartments and houses than other Canadian cities, with a rate closer to places like New York and San Francisco at the height of their mortgage crisis in 2010.

Downtown, the rate is so high that it’s as though there were 35 towers at 20 storeys apiece – empty.

That’s the latest discovery that adjunct UBC planning professor Andrew Yan made when he analyzed 2011 census numbers to try to add more information to the contentious debate over whether Vancouver is turning into a high-end resort or offshore investors’ holding tank.

He revealed those numbers Wednesday night, as a capacity crowd turned out to listen to speakers on a panel at SFU Woodward’s talk about “foreign investment in Vancouver real estate.”

In all, the city of Vancouver appears to have about 7,500 more vacant housing units than what would be expected in most other Canadian cities. For Metro Vancouver, there are around 15,000 to 20,000 more.

That sign of high vacancies and non-resident-owned units, which contradict some other studies and assurances that Vancouver is not being flooded with investors, should give the city pause, analysts say.

“What kind of community are you living in if there are that many empty? For a city to have that kind of vacancy, it’s like cancer,” said Richard Wozny, a real estate consultant, during an interview Wednesday. “It distorts density and it’s delaying the impact. It raises the question ‘Are we over-building?’”

Mr. Yan, who specified that it’s not possible to know exactly why so many apartments were empty, said data indicate Vancouver is creating neighbourhoods that appear to be very dense, but actually don’t have an active full-time population.

That gives a skewed picture of, for example, the amount of commercial activity they can support.

In Coal Harbour, where up to one in four condos is empty in the tower-dominated waterfront neighbourhood between Stanley Park and the downtown convention centre, the scattered shops in the area often struggle to stay in business. By contrast, the West End, which has a low rate of empty residential units, is bounded by three streets – Davie, Denman, and Robson – that are packed with busy small shops and restaurants.

Mr. Yan said that the high numbers of empty apartments don’t prove there’s a problem with foreign investors, but they do indicate that Vancouver has a large proportion of general investor buyers, be they offshore or Canadian.

Housing analyst Tsur Somerville, director of UBC’s Centre for Urban Economics and Real Estate, said the data he has seen also indicate that Vancouver built more housing in the 2006-2011 period than the number of new households that were added to the city’s ranks.

That means investors. There’s nothing wrong with that, as long as those units are occupied, said Mr. Somerville, also on the panel.

“The problem is vacant units since that’s demand for real estate without housing people.”

Mr. Yan’s analysis entailed isolating the census data on dwellings that showed up as either “unoccupied” or occupied “by a foreign resident and/or by temporarily present persons” on Census Day 2011, which was May 10.

“These units could be non-resident occupied because their occupants were just away for the Census Day, between rental tenants, or moving in a just-opened building, but there is also a chance that they are someone’s pied-à-terre, vacation home or empty investment holding,” observed Mr. Yan.

In the city of Vancouver, the rate of those kinds of dwellings stood at 7.7 per cent overall, with some parts of the downtown as high as 23 per cent. In the city of Toronto, the rate was 5.4 per cent; in Calgary, 5 per cent.

If Vancouver’s “non-resident” category had the same rate as Calgary’s, it would have had only about 16,500 empty units on Census Day – the level to be expected in a regular city, where some part of the housing stock is always going to be empty for one reason or another. Instead, more than 22,000 units showed up in that category. An analysis for the whole Lower Mainland shows that it has between 15,000 and 20,000 more empty units, proportionally, than the Calgary or Toronto metropolitan regions.”

– from ‘Vancouver’s vacancies point to investors, not residents’, Frances Bula, Globe and Mail, 20 Mar 2013 [hat-tip Nemesis]

—

Thanks to Andrew Yan for the research and to Frances Bula for the article. Usually we quote brief snippets from articles, here it is all succinct and interesting enough that we’ve quoted it in its entirety.

The phenomenon described represents an important sub-type of RE speculation in Vancouver.

The most crucial form of speculation driving our spec mania has been regular folks over-stretching to buy their primary residences. That represented the vast majority of transactions in the RE markets, and served as the most important engine to drive prices skywards.

A more obvious sub-group is the flipper, who buys to resell within a year or two, with or without renos.

This article deals with yet another sub-group, the speculators who buy and hold properties (in this case condos but also applies to SFHs) as, essentially, gambling chips. They are betting they can sell at almost any time later, and win. Up until recently, preternatural price gains have made this a profitable method. Not so anymore. We believe that a weak market and falling prices will cause much of this ‘shadow inventory’ to come to market in coming years, with dire implications for prices. This is part of the reason that price drops will beget price drops.

By the way, note how Yan says that he can’t be sure who is holding these units. My own bet is that far and away the biggest holders will prove to be local gamblers. That distinction is not, however, of any particular importance when it comes to predicting outcome. All of this is more evidence of the Vancouver RE market representing a speculative mania, and the outcome is inevitably going to be a collapse in prices.. that’s how manias everywhere always end.

This work is also pertinent to discussions regarding population growth and densification: “Vancouver built more housing in the 2006-2011 period than new households.” Perhaps Vancouver is significantly less constrained than many fear.

– vreaa

I’d like someone in the media ask the mayor of Vancouver his thoughts on the article.

Also, if he dodges the question ask if the numbers are correct what he thinks about the stats in this article.

And finally, given these stats how is he going to address the issue of unffordability for families in Vancouver? How is he going to ensure future generations of middle class families can afford Vancouver?

He continues to mention affordable housing. But this is for low income. He is killing this city and its legacy. Vancouver shouldn’t be a hotel for the Worlds elite before it has figured out a way for Vancouverites to afford their own city and have families in their city.

Keep dreaming. The mayor doesn’t have a lot of thoughts.

Seriously, if the Gregor wasn’t given a script every morning… he really wouldn’t know what to say.

[NoteToEd: He still ties his own shoelaces, though.]

How much is his government profiting? The contractors and their bribes to politicians doesn’t just happen in Quebec!!!!!

Anonymous -> There is no proof of any illegal activity.. but there has been a simultaneous alignment of innumerable parties with vested interests all ardently heading in the general direction of a spec mania… so a spec mania occurred.

Vreaa, I have no proof any bribes or illegal activities occurred. You also have no proof that it did not occur. But when there is so much money to be made as in the real estate industry, there must have been perks, kickbacks or something shady going down under. The polo

Iticians made it über easy for all types of developments to occur by changing zoning etc. now I think this was a give away deal. you don’t think having friends in high places didn’t help. http://vancouver.24hrs.ca/2013/03/11/prime-vancouver-city-land-could-go-for-1100-a-month.

The mayor will probably suggest to demolish these empty condos in favour of more bike lanes.

There are no restriction or controls for RE cash laundering in Canada – we are WIDE open for foreign influence and control. As a result we have what we have….poor locals that can’t buy a place unless they sell drugs I guess. Most EU countries have extra taxes and restriction as of what can or can’t taken over by foreigners. Open market, free trade is great isn’t it !!!

I agree, Loose capital controls in Canada, compared to other countries, especially Mainland China, where most of the overseas housing spec money originated.

My comment is somewhat off topic as it deals with real estate in the Comox Valley. But I think that what happens here may portend what is soon about to happen in Vancouver.

Despite a huge run up in listings and slow sales, prices here have held. Now the rush for the exits appears to have begun. Yesterday on Craigslist two bare properties located on the edge of the provincial Liberal government and Courtenay council backed “Jewel in the Crown” (local council description) subdivision which a year ago were listed for around $600k each are now asking $339k and $349k (vs. assessed value of $431k and $437k). From what I have heard the vendor is going to be taking a substantial haircut.

Yeah, prices can seem sticky for a long time, then suddenly levels can be redefined by a handful of sales.

The crash is unfolding exactly as predicted by the bloggers on this site. No surprise here.

This has to be a good thing, eventually, once the crash has progressed enough to affect the investors’ psychology.

That’s a good way of looking at it. Also look at units under construction vis-a-vis population growth. Oversupply, oversupply, and high prices. No Spain or Inland Empire; nevertheless… this time is different.

Central banks and governments cheer any kind of growth, including the cancerous.

What? No one wants to actually *live* in The Greenest City?

Greenest? I assume you mean the self-fulfilling (and self-deceiving) idea that this is the “BEST PLACE ON EARTH” city…

mould is green

Debatable if we’ve hit even one of three? Certainly not vibrant or affordable – which is rather unsustainable.

“We all want to live in a city that is vibrant, affordable, and sustainable.”

https://vancouver.ca/green-vancouver/a-bright-green-future.aspx

A whopping big 1.8% of all trips taken in Vancouver last year were by bicycle!!! How much ‘greener’ can you get? [/sarcasm]

And what percentage of Vancouverites go on at least one jet-away holiday per annum? And how much garbage into landfills??

—

Seriously, would LOVE to see somebody akin to Andrew Yan do an analysis of Vancouverites’ actual ‘greenness’. Results would be embarrassing.

@vreaa

That’s akin to the overweight person hitting the drive thru on the way home from the gym.

…yeah… while on a teleconference cell-call to everyone they know, telling them all they are all out-of-shape slobs and should go to the gym more…. (and yes, I would like to supersize my fries)…

My biggest peeve are the patio heaters! How they heck is the city green when every patio is blasting out heat to keep the outdoors warm for 3/4 of the year???

Build, baby, build!!!

DearReaders… albeit, not being one to gloat at the expense of or to otherwise speak ill of TheDead, it is nevertheless with ZestyGreatPleasure that I present for your delectation this morning’s Zen and Quote ‘O The Day

“Acting was my true love….and I buried that possibility by going into adult films.” – Harry Reems [1947-2013]

[LAT] – Harry Reems dies at 65

…The son of a small-time bookie and a housewife, he was born Herbert Streicher on Aug. 27, 1947, in New York City. At 18, he joined the Marines but received a hardship leave when his father became terminally ill.

Returning to New York in 1967, he acted in experimental and Off-Off-Broadway productions but turned to adult films when he couldn’t pay his bills, according to a 2011 New York magazine article titled “The Afterlife of a Porn Star.”

He went on to appear in more than 100 hard-core films that included 1973’s “The Devil in Miss Jones.”…

…He didn’t stop drinking until the late 1980s, when he ended up in Park City, Utah, and entered a 12-step alcohol recovery program.

Once sober, he sold real estate. Reems also turned toward religion.”…

http://tinyurl.com/bw47ele

[NoteToEd: I believe one of Arthur Miller’s LittleDitties once addressed those themes… although I think we can safely say that WillyLoman’s story isn’t half as interesting as Harry’s. NoteToJonnsonsRod: I would have run with the leader “From DeepThroat to SubPrime: Death Of Realtor”.]

hahaha.

Well done….

Further thoughts on Yan’s findings and this article:

– Important simply because the G&M has published the idea that Vancouver may be ‘overbuilt’.

– Ball-park similar findings to the discussion of BCHydro figures a few years back (18,000 empty units in Metro Vancouver, if we recall correctly).

– What does this mean for all the towers currently under construction?

Are they now building empty towers 36 through 47?

Lululemon Says Sheer Yoga Pants Undetected Until Bend-Over Test … http://tinyurl.com/cdn432e … fire faulty qa team, replace with detail-oriented male volunteers – cut costs, improve quality, win-win

I think the Vancouver condo market is about to get the bend over test.

Yeah, RE matters will become more transparent.

I thought the whole idea of wearing “yoga pants” in public was to be revealing? ….if Lulu knew anything about marketing, they would’ve labelled this batch “ultra-sheer” and jacked the price 20%….

yes but try bing images for sheer yoga pants … too revealing = trashy = $19.98/pr not $98/pr … pls outsource qa/qc to me … i will hire models to try on yoga pants and bend over – to be funded by charging fee to inspect models bending over (yes, this is #1 reason for men in yoga class … but women will also pay to inspect men bending over) … i would give anything to have participated in the escalation from initial discovery through issuing recall notice – lol! … to their credit, they recognize when their livelihood is threatened and took quick, fairly decisive action … no denial … meanwhile elsewhere ww

http://www.girlsinyogapants.com

Overbuilding, vacant units etc.

End result of the ” I buy three, my sister buy three” mania.

Hey people were buying until last year. Once you get the wheels in motion for a project its hard to stop. I guess this shows some developers believed demand would go on forever.

I attended the talk last night. The key points I thought were made, and some great lolz from Somerville, were:

– Yan asked to properly define “foreign”. He thought the term was more nebulous than what people might think.

– Sandy Garossino highlighted how Vancouver is not alone with having vacant units, it’s a problem bigger than the city.

– Garossino highlighted how having vacant units imparted externalities on the rest of the populace and that should be taken into account when forming public policy

– Somerville stated that more supply is needed but impaired due to geography and zoning. Said that in a city as dense and constrained as the City of Vancouver having 5000sqft lots is not a good use of space but zoning is not allowing the full gamut of choices to be pursued.

– One person questioned whether laneway/basement suites is a form of added density Somerville was alluding to, Somerville stated suites is not the same as subdividing into single family houses on smaller lots.

– Somerville commented this is nothing new but really hit the media’s attention when westside residents started selling their properties for multiples of purchase price.

– Somerville and Sutherland (the moderator) commented that investor immigrant intake appeared to be correlated with the run-up in westside/Rmd/WestVan prices. That program has been given the old nutshot and sales/prices have fallen. Tsur was pretty blunt at the end that that “dynamic” was something to watch.

– Sutherland also stated that the run-up since 2008 is a Vancouver and near-burb problem primarily; go further afield and prices have dropped since the peak, in some places by 10-20%. The recent problems of high prices are not evenly meted.

– Yan from Bing Thom Architects made the comment that “security of tenure” is a big problem, having high prices isn’t a problem if rentals could be provided that allow people to stay in one place at their prerogative and not of landlords looking to liquidate. Tsur commented the concept of staying put as desirable is a state of mind (ie if people like being nomadic having security of tenure doesn’t add much value), which is fair but likely not the norm,

– Yan had some data on the vacancy/foreign-owned of various areas of Vancouver, he showed that it was mostly a DT thing and outside there isn’t overly-high vacancy rate. He offered many more caveats on his research than Bula highlighted so IMO you have to be very careful inferring that Vancouver has a significant vacant unit problem.

– Garossino brought up the idea of taxation as a method of controlling speculation. Not sure if she was meaning foreign-owned specifically (I don’t think she did because she made it very clear “foreign” wasn’t the crux of the problem, it was capital allocation). Also she highlighted other areas’ methods of providing housing such as Singapore that has off-limits zones for foreign ownership.

– Somerville brought up the concentration on Chinese investors and thought it wasn’t warranted, ie other cities have other nationalities that are investing in RE, Garossino thought that argument wasn’t “helpful”. (I agree it’s a bit of a strawman, but I thought Somerville needed to lob that one into the court to be rebutted.)

– The panel used the word “investment” loosely and did not define it. I thought that was missed, ie those who own-occupy are, or at least could be, investors as much as those who buy condos for profit. The only difference from strict investment POV is they rent to themselves.

Thanks for the summary, jesse/yvrhousing; much appreciated.

When you say “you have to be very careful inferring that Vancouver has a significant vacant unit problem” — I’d say that’s a profound disconnect between what you heard at the presentation and what the article presents. Re-read the first three paragraphs to see the difference.

If you heard right, shouldn’t Yan be objecting to Bula regarding misrepresentation?

I think Yan deserves to be properly cited. Frances should know better, being head of journalism at somewhere or somethingorother

PS I was the guy with the bear mask on. Yes that’s my real face. Don’t judge me.

Thanks YVR. Great summary. I think you have picked up on the agenda for the future as well which was stated n this short one-liner from Tsur…..”Somerville stated suites is not the same as subdividing into single family houses on smaller lots”

And the reason that “suites” is not the solution is because developers cannot make much extra money putting them in. Not compared to creating SFH anyway. We need to appreciate that those big on R/E are not going to stop no matter what the price of housing in Vancouver. It means that a migration of applications on density will arise with requests for subdivision all over the city. Most particularly in the West Side if they can get city council to sign on. And why not? If you cannot get a million bucks for a lot anymore then the answer is to turn it into two and ask 600k apiece (or more as the case warrants).

You know it’s going to happen. Somerville just told you.

Somerville was actually quite funny in his speech. He was mostly about adding to supply, but he said people often ask him what he would do if he were in charge and he said that what he would do would require him having a 24 hour escort not only of police but also of the Canadian army as westside residents bemoan his policy of ruthlessly rezoning palatial underused west side lots into denser freehold single family lots. His point (I think) was along the lines that you can’t reasonably complain about investors on one hand then hoard underutilized land on the other.

Yan showed 2011 census tract data on how little vacancy there is outside the downtown core and he admitted upon probing from Gordon Price that he hasn’t looked too much beyond Boundary Road in doing his analysis. Price has long been an advocate for regional, not city-centred, thinking

Some definite food for thought there.

Did anyone watch the late news, CTV, last night. Study was out that Vancouver is not the BPOE. We are rated 52nd ( I think) in Canada. CALGARY is rated number 1…LOL Calgary BPOE!!

High living costs was one reason…Real Estate was another..

http://tinyurl.com/y8uhy9o … note vcr verbiage wrt best place for immigrants

Very helpful post on Andy Yan’s excellent work and Frances Bula’s fine reporting.

Illuminating VREAA-host analysis as well.

As the issue of empty dwellings always brings up the issue of “foreign” investment, here is Andy Yan’s “reading list” on this issue:

http://www.btaworks.com/2013/03/18/suggested-readings-on-foreign-investment-in-vancouver-real-estate/

Hmmm…

Wonder what that number of vacancies would be if you add in all the court ordered sales and mortgage foreclosures…that have not been made public…

I’m sitting on a recently purchased foreclosed and court ordered sale in mission.

Let Vancouver and its “investor” idiots burn

…hopefully the heat will drive away the rain…

here.

I will now take time and enjoy sitting on my decrepit old porch and drink coffee while watching the fun…

… now what was it my agent said to me… some 70% of the condos in the lower mainland are spec and investment units… hmmm

hopefully he’s pulling my leg….

Silver, Your agent is right!

Yikes… He a tally said 80 but I didn’t think it true…..

I lived in Shangri-La last year for 8 months. (furnished 1bdrm granite/in-suite laundry/internet/cable/utilities/1parking/concierge/pool(tiny)/sauna/fullgym/yoga room for 2200/month) -670+- sq ft retail 650k

there were 8 units on my floor and beides min only 1 other was occupied full time. by a mexican family of 4 renting (two bdrm 1500 sq ft) next door was offshore (korean) who was there for 3 weeks of the 8 months. of the rest on of the suites down the hall appeared to be on offer as a short term rental as there was one weird looking – socially deformed troll looking guy (tech guy on contract) the rest were never occupied.

In the elevators there was not a variety of faces for the tallest building in the City. A lot of the usual suspects. And i keep weird hours. Working Asian markets. Lunch at 10 am. Gym at different times. Clubbibg. So i had a good sample.

Speaking to the concierge learned that prolly 50% of the building was vacant…”officially” He pointed out a number of people who rent out didnt keep the concierge apprised of goings on as they were supposed to charge 150$ move in/out fee to new tenants. nudge nudge wink wink

My landlord owned one other one bedroom in the building as well as a condo at fPac Rim and a couple down on Beach ave. plus his primary West Van house.

Hanging out for drinks at the various hip and expensive watering holes around coal harbour speaking to people learned that similar situations existed in their buildings. seemingly 1,2,3 active actual daily residents on a floor. 1-2 short term rental units the rest. empty.

My surmise is Mr Yans data is not anecdotal or because so many people just happened to be away on census day. But is in fact underreporting the number of empty condos especially in Coal Harbour.

I would sit in my suite every night looking WNW and shake my head in wonder at the 6 lit suites in the 25 story buildings on the horizon night after night.

“…there was one weird looking – socially deformed troll looking guy..”

Hey… hello neighbour!!

—

Seriously, thanks for the story. Suspect you may be right regarding even more vacancies than Yan estimates.

He said, “Troll”… not droll.

Sheesh. Anyone can be an editor these days!

Well, i’m glad to see that the pundits are finally removing their blinders and are admitting that there is an abundance of vacant properties in Vancouver.

I guess the next step will be to finally admit that a large portion of these vacant properties are indeed held by offshore investors.

In order to solve a problem, you have to admit that there is a problem.

it wasnt personal. i did say hi and am a very gregarious outgoing person. (which makes living in Vancouver all the more tortuous) but he was a weird looking mutton chopped guy who WAS a techie on a contract and found conversation very difficult and had apparently odd bathing schedules. and did have hunched shoulders and wads of body hair poking out from all over his tshirts.. so theres that,

This highlights the under-reported enormous wealth of some residents in Vancouver, and in many other cities around the world. The small percentage that makes the market – Pareto’s Law.

The ultra-high-net-worths are buying these high end condos as part of a portfolio. Some as a store of value others as a means for cash flow. They won’t sell unless there is an alternative for their money. Some of this wealth has been moved out of China/Hong Kong/Singapore/Korea etc. to be parked in Vancouver as a safe haven by new immigrants. These immigrants, at least the wife and kids, live in Vancouver so by definition they are Canadian and are not foreign investors/speculators.

I would venture a guess the units at Shangri-La and in Coal Harbour are not highly leveraged to today’s prices. Many of these units were bought pre-2008. The fact that they are not rented out or used only as part-time homes show the owners are not simply investing for cash flow. Nor would short term speculators that require leverage take a chance on these high end units – they would be more inclined to take a punt in the $300k-$500k range as they are the most liquid units.

In effect, the rich are getting richer and the poor are getting poorer in today’s world. The asset rich, cash poors are those who have lost to greed and fear and have bought on high leverage. They are the most vulnerable and do posses the ability to bring about a decline to Vancouver RE prices. The question then becomes whether foreign investors or new immigrants will continue to pile money into Vancouver RE if it is perceived cheaper than Australia or Toronto?

Folks, there is no precedent to what Vancouver and the rest of the world is facing economically. From RE perspective, on one hand, property prices in many cities are over priced to traditional fundamentals. On the other hand, unlike eras gone by where high prices were supported mainly by leverage, there is a large contingent of cash rich buyers these days.

Debt (including mortgage) to income ratio is high. Debt to property value is fine in Canada. The great concern is that the central banks are no longer certain about the effectiveness of their policies anymore. Traditionally, if the Bank of Canada raise rates, asset prices fall in tandem. In today’s world, that may actually attract more capital from around the world to park in Vancouver – unprecedented at this scale.

The odd thing is, if the key economies continue to get worse, money will get cheaper and the rich will get richer. If the key economies recover fully, high property prices might warrant its lofty prices.

Unless monetary policy dramatically changes, the bears and bulls will probably just meet somewhere in the middle. Limited correction, limited appreciation.

[NotToReaders] Apologies in advance for spelling mistakes and grammar. Typing from phone.

You typed that from your phone? You need to spread your wings away from this blog, you have so much to offer the rest of the world.

You have to have a little sympathy for retailers, shops and restaurants in those high vacancy zones. Parts of the downtown are really becoming a twilight zone as an outcome of the speculation and property hoarding. I am not even sure it matters exactly why it has happened although the phenomenon is clearly having an impact. The old downtown of rental buildings below 20 stories always seemed to be full back in the day. Families lived there too. There were years you had difficulty finding a decent place and the downtown scene was pretty vibrant and social. It was of course a community then. But the new condo towers on coal harbour struck me as a ghost town when I was there last visiting. We were walking the dogs along the seawall and looking up at all the new towers at night and they were almost all in blackness. Perhaps things have changed but I would be willing to guess vacancy rates are even lower than stats are telling us. I am only going on the eyeball test of course. Buildings in darkness tell me nobody is at home. Actually False Creek on the West End side was pretty much the same story. The only lights were those lit by the city along the wall walk. Thing is that people renting premises and trying to do business are sometimes taking leases on the implied promise of traffic that is being generated by all the new builds and presumed density. This study will give them some needed room to negotiate fairer prices for space. Should not 20% fewer people not result in discounting asking prices for ground level retail space of an equal amount? Are they not being led down the garden path when opening a small cafe or coffee shop only to discover nobody is coming because nobody actually lives there?

It isn’t just Vancouver or Ditchmond….

Witnessed this phenomenon in Richmond Hill, Ontario last year. Used to live out there, moved West in 2011. New condo went up on Yonge Street back in 2011, south of Major Mack, north of 16th Avenue on the East side of the street. Once it was completed, I took a stroll in the evening and counted perhaps 10% of the units had lights on….

Now, the super-Bulls will always say owner/occupiers have the lights off because – unlike pathetic, basement-dwelling renters – they are out tripping the Light Fantastic almost every evening. Back when I had a mortgage I was too broke to do anything except stay home and watch TV….but that’s neither here nor there. Clearly, this is a different paradigm….

Fast forward to last Summer (2012), and I’m back visiting in the old Hood….so I took another (several) strolls in the dark of the evening, middle of the week, past the very same Condo Building. Turns out there were now about 35% of the units with any sort of illumination leaking out….

What’s the explanation? Blackout curtains for an Air Raid? Residents practicing with their Night-Vision goggles a la Zero Dark Thirty,…? Your guess is as good as mine….

TheSootyHarbour was home from 2005-2009, Farmer… and I can confirm, it was/is a GhostTown RE ‘Bank’… I used to call it the, “BBC’s HolidayDormitory [BillionaireBoyzClub]”.

[NoteToEd: It was hard work for a LowRentInterloper like ‘Nem’ to fit in with that crowd but… EpiphanyOfEpiphanies!… one day, upon observing a professional dog walker on the SeaWall it suddenly occurred to me that during the SalmonSeason the HardCore Yachties/SportFisherman might need someone to mind/exercise their TrophyWives for them… Or, at the very least, properly inspect their YogaPants prior to putting to sea. So, I opened a little kiosk on the marina next to the Ship’sChandlers and never looked back… Of course, after three years of ‘that’ I was badly in need of a ‘vacation’, so to speak. And I wasn’t getting much writing done either!]

GhostTown, that is the same thing I have expected to be seeing around that area, and I have been curious why the Mayor can be so commited to fund the 2.8 billion for the broadway corridor subway before his leaving office.

Makes sense that the best way to know about a building is by living on the inside and getting to know who is who by taking the daily elevator rides. Coal Harbour really is a bizarre neighborhood. There are more joggers (er I mean marathoner’s) and dog walkers than there are residents in the towers. How did the kiosk work out by the way? What were you selling? Just wondering, The wife or I may have shopped from you in that area. It was not jewellry and precious stones by any chance?

I would never, never show a Gentleman’s Consort my PreciousStones… Least of all a Farmer’s!

if you’ve got it, flaunt it.

Hide the fact you’re a RE bagholder, just like you must never again wear sheer yoga wear because yo’ ass is now fugly.

This is getting tiresome More media lying and manipulation in real estate pimping. Step forward The Province in todays “Business” section

http://www.theprovince.com/business/mortgages/Buying+your+home+should+enjoyable/8130388/story.html

Here we have the very hot young blonde and even with a twin sister who was oh so slightly bewildered by the process of purchasing her first home that she felt the need, nay the calling to endevor to assist and advise other wayward lost puppies..er souls in navigating the trying times of purchasing their first home, shes like a an evangelical for enjoyment, She shared her thoughts in an “interview” with the reporter. And the reporter touched up her photo to get that real soft focus angelic thing going on.

In paragraph 5 we learn that she is actually a used house salesperson for the ReMax cartel. Fair enough Then we are reminded again that this hottie has a twin sister. Her sister isnt a UHSP but rather who she purchased her home with. And hey. Who wouldnt want to remind readers that this hot blonde 26 year old angel has a twin sister.

Then we are regaled with the details of her specific experience. 300k mortgage 291k condo 8% down payment from an RRSP. suspiciously specific. for a feel good human interest story of a poor girl and her twin sister and the bewilderment of lost fawns scrambling threw a dew covered meadow on a bright spring day just trying to find their way to nirvana and enjoyment of home ownership and being inspired to accept the calling of advising and assisting others. From the milk of human kindness overflowing in her angelic heart. Who wouldnt want to be her, or be her mother, or be the guy that the reporter keeps emphasizing the twin thing to.

As my nausea was increasing and my cynicism meter was red lining i came to the punchline of the “article” that i will remind you is featured on the BUSINESS section of the province.

• To be featured in the Province Focus pages, please go to theprovince.com/focus

This link directs you to the advertising opportunities page of Pacific Newspapers.

Bought and paid for advertisement with no mention that its an ad. Rather it is purposely disguised as a human interest story. FML

The author of this dreck is Robert Matas on linkdn as “Former” Globe and Mail journalist. I guess this guy didnt want to start a blog. So now he freelances advertorials.

[Etymological FootNote: “TSM”=”TopSecretMassage!”]

‘Thanks’ (we think).

From the ‘article’:

“When Hind and her sister bought in 2011, the market was extremely active. They were under pressure to decide quickly. The market is much slower this spring, but not as slow as last fall, Hind said. Last fall, buyers were paying five per cent or more under asking price. But prices are returning this spring to close to asking price, she said.”

Really? From what we hear price have weakened further. Perhaps asking prices, too?

I don;t think facts are supposed to get in the way of your “enjoyment”

OMG! Ront, did you say… “TSM” TwinSeesters!???

[NoteToFarmer: On this occasion only, there is neither anything particularly instructive nor a HiddenDeepMeaning beyond, “SexSells”… I just thought that JR could use some inspiration to complete the BusinessPlan for his UltraSheerYogaPants® KioskFranchise, that’s all. NoteToEd: Pray forgive me. I am presently in the midst of GirdingMyLoins for a TopsyTurvy GlobalMacro week… or two… or three. By the way, speaking of the “IkkiTwins” – and strictly between the two of us – a while back, I couldn’t help but notice on my way into the now SadlyDefunct JazzRhythm&BluesClub at the Yale, that a certain “Tiffany’sHind” featured prominently on TheMarquee/Showbill @ the now EvenMore SadlyDefunct Cecil… but, of course, that’s an altogether different business, right? So it couldn’t be…. Right? Right? Either way, stranger than fiction, “Drôle vieux monde, vous ne croyez pas, RédacteurEnChef”?]

[Etymological FootNote: “TSM”=”TopSecretMassage!”]

NoteToEd: FatFinger ‘OutLining StackError’

Oh no, that was very instructive. Amazing how the same lessons keep being educational over and over again. By the way, try to forgive if it seemed your name was taken in vain (as it was not). You must appreciate I needed a real world example to make my point for freedom of expression!

The bank pre-proved them for 400k, but they knew that they could only affford 300k.

Another good example how “prudent” our bank’s lending practises really are.

But why would they care, anyway. CHMC a.k.a. The Taxpayer will pail them out if the borrowers default.

Tsurly he can’t be serious? Does Somerville ever say anything that doesn’t amount to strutting Kingsway dolled up in a sandwhich board and stilletos for the RE industry?

A few very simple things

1. Builders don’t stop building condos until a project goes bust.

2. Vacancy = non-resident owned — they are the wealthy

3. This is just the Hawaii problem where all the rich Canadians and Americans bought up all the condos.

4. The issue (not good or bad) of Vancouver becoming a destination living City has been going on for 10 years.

Problem!

Can’t swim in the Ocean. And we don’t have Hula rings.

Or Hula girls… well, at least during this time of year. (Or Hula guys / flame jugglers…)

I know Richmond is a Destination City for Chinese because it has the best Chinese food outside of China.

And you can’t catch a decent fish worth eating within 30 miles of the city most of the year. Some of you people will be shocked when I tell you we actually used to go fishing in the harbour and off the docks……these days…. Yuck.

People can laugh but Bing Thom mentioned 2/3/4 as a potential issue at least 10 years ago.

I guess thats how the mayor can claim Vancouver is one of the greenest cities on earth.Nobody really lives here , just more smoke and mirrors.

No actual residents = very low carbon footprint

Sorted!

Nice observation!

So wait. If no one lives here, why do we need bike lanes again?

Why? Because Translink there would be no vehicles running!

It is the working poor in the cars. Give them more space.

i am greatly intrigued by this bend-over test … how it’s supposed to look? … http://tinyurl.com/c2yfupz … vs is that pantyhose? … http://tinyurl.com/brucgu9 … subjective perhaps … but, crossing that line (imho) loses one all claim to credibility as professional or amateur practitioner of the ‘art’ … explains why management was quick to act so as to restore trust … pffft! … most unlike when the cypriots’ deposits were exposed in a parallel bend-over test … @520 for cyprus-specific commentary … http://tinyurl.com/cr8m23t

oopsies … svp, m. ed … comment_purgatory = 1

“There’s nothing wrong with that, as long as those units are occupied, said Mr. Somerville, also on the panel.”

REALLY Tsur, REALLY?

1) Real estate is not only about asset pricing. In fact, in Vancouver, real estate could not be more out of touch with what asset pricing theory and equilibrium models have to say. It’s about demographics, and the intertemporal choices that the “young” in an OLG model make. If the young domestic workforce is crowded out of the market, likely not coming back to be around when the older want to cash their gains and retire. Now let me hear your take on how the current market trend actually creates efficiencies, more revenue for all levels of government, that will be uh-so-effective at re-distributing those gains and improving economic welfare once shit hits the fan.

2) I’m sure they’ve taught you in Harvard that throughout the economic cycle, investment volatility is a couple of times higher than consumption volatility. If we are to assume that everyone wants stability and to “consume” some housing (be a homeowner for the sake of “consuming”, not investing), then do you really see no problem with overseas investors crowding out the locals? What condos do you think will first go on sale once prices start to drop? So it’s not a problem for foreign money to leave quickly (in chase of more promising investments), effectively leaving underwater the majority of our gullible, mortgage-loving households.

Tsur went to Harvard?

No wonder he’s so out of touch.

Ivory tower elitist who lives in Point Grey, trying to protect his investment.

I don’t suspect that foreign money has any intention of leaving Vancouver anytime soon, Kevin. Where else would it go in any case…..certainly not back home. You need to appreciate that those with significant wealth are far less concerned about the price ups and downs in Vancouver as locals are. Their reasons for owning there have less to do with asset building and speculation than it does with a form of security based upon having easy access to a country with a stable political climate and excellent services. So these homes are for the long term no matter what happens and that suggests prices will not fall dramatically at any given point based on foreign owners bailing out of the market. I mean to say falling prices don’t concern them because that is not the metric that was behind the purchase in the first place. Price sensitivity is for people who need to apply for a bank mortgage hat-in-hand and get permission from CMHC to be insured. If you could afford it would you not live in the best neighborhood in the city of your choice? Well then if you could afford it would you not also choose the safest and most desirable cities from those on offer. That is why Vancouver is such a magnet. Despite its limitations it is safe, friendly, stable, open to investment and more cosmopoloitan than some might like to admit. The days of Vancouver being a predominant blue collar middle class city are gone. Instead there is a segment of the very wealthy (even exceptionally wealthy) that can hold empty inventory longer than most here can keep a marriage together. Might as well adjust to the fact Vancouver will never be the same. Those who hoard homes and condos as inventory have little interest in the local scene or what residents think until it actually affects them. I favour a special levy or tax on vacant homes and think it is appropriate given all the negative outcomes of having so much housing stock withheld from the population that actually live and work there while harming the local retail sector with an absence of clientel. Even empty homes consume a portion of local services roads and infrastructure but if they make no contribution to the local economy in the form of tax revenues generated at all levels of government they become a drag on the local economy. In short, no people equals no spending and no significant consumption…..and as we all know, almost 65% of our economy is consumption driven. So it matters when 20% of a community is empty year round.

+1

Thanks BLM. Hopefully others feel the same way. We cannot change the past but we can certainly affect the future. I am on the side that is in favour of promoting equity for those who actually live and work and raise families in the city of Vancouver. I am in favour of taxes or levies on absentee landholders and those who merely use our city as a dumping ground for surplus cash. This would never have become an issue except that this current situation is clearly so exceptional that it must be adressed head on.

My sentiments exactly. Some policy, tax or regulation is needed to stem the flow of excess safe haven capital into Vancouver’s real estate.

Now the billion dollar question is how to do it in a way that is fair to all the other cities in Canada? The last thing BC needs is to politicize this issue nationally by pushing excess capital into Alberta or Ontario.

BC and Alberta can’t even agree on an equitable deal on a money making oil pipeline. Nor can the country agree to one securities regulator, like all other countries have. A local issue on real estate prices doesn’t really stand a chance it seems.

Interesting article… Like family she says, get used to it.

http://www.nst.com.my/opinion/columnist/chinese-buying-spree-worries-new-zealand-1.239567

Wow! TrueThat. Thank you.

[NoteToEd: On the BrighterSide though… That’s why the ‘Couver doesn’t ever have to worry about becoming a “CircularErrorProbable” factor on a TargetingAnalyst’s spreadsheet.]

Most of these vacant units around Metro Vancouver – 15,000 to 20,000 – are mot occupied just because there is no population growth to match the growth in the condos numbers – the recent population growth facts were recently posted here in one of the discussions, I can’t find it – may be our host can point it? Most of these vacant units are just waiting to flood the market after their owners eventually get tired of having the negative cash flow rental properties. And if they decide to keep holding them – well, it is at least some money flow for the local economy – they are going to keep paying condo fees and property taxes, support the local economy.

The money that owns the apartments and homes in question are not going to be materially affected by the rise and fall of Vancouver housing prices Olga. They really do not care as the “price” is not the most important metric for them. The much discussed worry over home values is a sentiment embraced universally by working people and those who have few other options to relocate. This is about a class divide. Sorry to have to tell you so bluntly.

Class divide is the key word here.

We can moan and groan about the high shorelines but the peaks and troughs of the cash waves are ultimately controlled by the lunar forces that are the central banks!

You are kidding me. You are bluntly assuming that most of these vacant apartment

are owned by the overseas investors that do not care about their returns – and on what ground?

Not everyone cares about investment returns Olga.

If that was everything that mattered then the whole world would buy houses in affordable neighborhoods with some upside growth potential. Obviously, they do not.

As we know, there are many people prepared to pay very high premiums over cost to live in established regions with good services, quality schools, efficient transportation, walking distance to shopping, political stability, good policing, low crime rates, nice views etcetera…etcetera…..

You get the point. There are a great many other factors at play.

Money is just one of them. And money worries and investment returns are usually the domain of those who can barely afford to live in the place of their choice to start with.

So who buys a million dollar condo and lets it sit empty most of the year? I am asking you to think it through. You probably cannot do it and many others here who rent cannot either. I would suggest that they don’t understand the basic mechanics at play.

if you had any money available, would you stay where you are?

Farmer -> Fair comment, but I don’t think the majority of these empty properties are owned by people so wealthy that they’d be impervious to large price drops. I think most owners of these properties are simply momentum investors (local and foreign)… they loved Vancouver RE when it was going up, and they’ll fall out of love with it just as quickly on the way down.

While I agree that a small percentage of owners of these units may not care about the prices going up and down, most of them are likely to be speculators and wanna be investors. The whole argument about everyone in China trying to park money in Vancouver is defunct.

I know of many many regular guys who have bitten off more than they could ever chew.

There is no doubt in my mind that this is a prelude to major crash

I do not really get your point here – these condos in discussion are sitting empty, lots of them are on the rental market – consult the craiglist, it is flooded now. they can not be rented at the price that would be reasonable based on the price of the condos. Your example about people that prepared to pay very high premiums over cost to live in established regions with good services, quality schools, efficient transportation, walking distance to shopping, political stability, good policing, low crime rates, nice views applies well to the primary residence but not to a condo in downtown.

Of course, some of these units are held by wealthy investor class immigrants that have taken an advantage of the recent gov program and got themselves a Canadian residence and a condo to live there comfortably when visit – they are more likely to keep them. But also there are the speculators (overseas or local in the pools) that buy a million dollar condo and lets it sit empty most of the year hoping for the appreciation not to rent it out, they are likely to sell them to cut the carrying costs if the growth will not materialize.

I do not have any means to find out what the proportion between them, but neither do you. At least on my side is the sluggish population growth and continued mortgage debt growth.

And to answer to your implication “You probably cannot do it and many others here who rent cannot either. I would suggest that they don’t understand the basic mechanics at play. if you had any money available, would you stay where you are?” – I have enough money to buy a condo and a SFH but I won’t do it in Vancouver. And I am staying exactly where I want to – in a rented SFH in Terra Nova in Richmond, it is convenient for us now but I do not know for how long, and with the RE market on a decline it does not make a sense to buy now as the probability to loose money in the next few years is high, and the liquidity is going to be low for awhile.

It’s worth noting there are a lot of people in your situation out there. Capable and ready to buy. The market does not appear to be exhausted of buyers which means there is some support for prices even if it continues to trend lower.

What I hear: fundamentals don’t apply.

What paying for poorly-returning investments amounts to, from what I see, is money flowing to its rightful owner.

“The market does not appear to be exhausted of buyers which means there is some support for prices even if it continues to trend lower.” – who knows how many people are sitting on the fence, with the ownership rates more than 70% I do not think that it is a lot, willing and able (qualified) to buy RE at the current price point. In the US the RE market went alive after the prices have fallen by 30-40 and it hit the mass customer layer.

I think it is now clear that blm is either a realtor or a scared “investor” (if it wasn’t obvious already)

Bubbly – #cynicism #witchhunt

Re BLM

Probably a scared investor.

Seems to have more wits than a REALTOR 😉

I don’t know about Craigs list, Olga. Never looked in on it. I base my evidence on what I have seen in the form of absentee owners. There is no people and the lights are not on.

If those buildings were tenanted would we not see signs of life?

I agree though that none of us here can draw any final conclusions. We don’t in fact know the names of the buyers whether they be local or overseas so there are assumptions being made based on our knowledge of other areas.

I did see a similar situation in London though. The toniest and most expensive buildings were also fully in darkness at night and it seemed to be well known that a combination of Arab, Saudi, Russian and other European money had staked out these places.

Trust me that there was a real sense of resentment about it too. The English feel really imposed upon; think they have been disenfranchised in their own country (not just a single city) and the conversation invariably turned ugly and bitter whenever it came up.

Getting back to the point….it is easy for me to come to the conclusion that most of the Coal Harbour area is foreign owned just on the basis that if it were local owned they would most likely be tenanted.

For example, if your rich Uncle or wealthy Grandmother was a speculator and had bought one or more units but knew you needed a place to live in the downtown area for work don’t you think it likely they would allow you to park yourself there until a buyer came knocking?

Families still support one another don’t they?

This seems obvious to me. Those buildings function more like “parked assets” than homes. They represent bank accounts and pit stop accomodations for the wealthy who are far less concerned about the possibility of price declines than they are about having some of their wealth stored in a safe country.

I have to throw my vote in with the Farmer on this one.

You can go to your local bookstore (how quaint!) or on Amazon and find many, many books on real estate investing. They all share pretty much the same formula: Find a rentable property, put only enough cash down on it that the rents cover the mortgage, maintenance and expenses, and slowly your tenants pay down the mortgage. If conditions change and the rents no longer cover the expenses, you either sell the property or rent at a loss (temporarily, you hope) and make up the difference by writing cheques.

I challenge anyone to find a real estate investing book which recommends leaving rentable properties vacant for a long period — they just don’t exist! Even if your goal is capital appreciation, why would you forego rents?

No, these properties must be stores of value, or casino chips as vreaa called them (also a store of value). It’s hard to make a case that their owners would be devastated by a 10% or 20% drop in value but are perfectly willing to forego 3-4% value annually in rents.

If anyone wants to do an experiment, here’s how. You need to be friends with a real estate lawyer. Make a list of 10 or 20 of these selected dark units, by observation, or better still, by getting friendly with a doorman who can tell you which units never see visitors. Have the lawyer pull up the liens on those properties. (You can do it yourself at the land office here in Ontario, but it costs a bit of money). If they’re mortgaged, they’re investments. If title is clear, they’re stores of value.

Farmer, Ralph. You guys put it more eloquently than I can. Here in Hong Kong, where the same issues of foreign money and high property prices exists, the store of value argument could not be more obvious!

Property transactions here are much more transparent and to anyone with links to both Vancouver and Hong Kong (or other parts of Asia), things could not be more obvious.

It is perhaps why Asians in Vancouver also, disproportionally, make up a higher ratio of speculators (yes, they of course exist too).

Regarding checking whether there is a mortgage or not, most real estate agents, accountants and lawyers will advise their clients to take out a small loan to avoid catching the taxman’s attention. It’s not that the money is necessarily illegitimate. Buyers just want to avoid the hassle.

Anecdote: there’s this intern in my office, who I was chatting with because I saw his Canadian passport, tells me he was born in Canada and never lived there. His parents took him back shortly after he was born in the 80s. They bought an apartment in downtown and continue to hold it today, vacant. Some realtor continues to manage it for the family as an asset. I casually mentioned to him of how high prices are these days but he seemed unamused.

Ralph -> “I challenge anyone to find a real estate investing book which recommends leaving rentable properties vacant for a long period — they just don’t exist! Even if your goal is capital appreciation, why would you forego rents?”

—

Because, through the spec mania in Vancouver RE, the capital appreciation has been so large, and the rental income so small (cap rate 1-2%, or even less), that it has been tenable, and easier (less hassle) to simply leave your investment unit/s empty.

But, with prices beginning to fall that changes. The premise for holding the property disappears. (This is classic momentum investing; you’re happy if

—

Regarding the discussion above -> I think that the percentage of Vancouver properties held by people who genuinely don’t care about prices is very, very small. And remember, when prices start dropping, it doesn’t matter whether that percent is 1% or (a much larger 10%, or even more)… it’s not those owners who will be deciding the prices… it’s the 10% to 20% of owners of all property types who DO care very much about prices, and who come to market, who will cause the crash. Prices are set at margin, as we all know. [separate question: what percentage of owners have to come to market for a market to crash?]

And, BTW, I suspect that there are enough owners of those vacant condos who care enough about its market price to also come to market in that scenario.

Well vreaa, maybe so. But just to nitpick, when we talk about cap rates being 1-2%, that’s net rents after expenses. Most of the expenses still accrue with the unit vacant, so it isn’t the net rent that is being left on the table, it’s the gross rents. Any investor, even a somewhat lazy and stupid one, would hire a property manager, rent it and defray those taxes, maintenance fees and transaction costs.

Ralph -> Very fair nit-pick; correct, gross rents would be more than 1-2% (but not much more).

—

I trust that you know I’m not saying it’s good business for these owners to leave properties vacant… but that is simply why it’s been happening.

Editor, Farmer, apologies for butting in.

Let’s say some of these units are not actually vacant but are actually summer homes for snow birds. They’re less talked about but they make up a lot of the ’empty condos’. I for one know four people (two in the US and two in HK) that own units in DT Vancouver for this purpose. Family/relatives are still in Vancouver, they grew up there and are now working elsewhere but return every summer. I hear, from friends in Vancouver that this is very prevalent.

Of the four people I know, three bought before 2008 and one in 2010. I’m unsure if they’re leveraged or not.

“They make up a lot of empty condos”. Do they, really, BLM,?

You have to better than that, otherwise you’re just wasting everyone’s time. Please provide data / statistics, or something more substantial than the “four people you know”.

I can’t prove it. I should have worded the sentence differently to say ‘perhaps’.

It’s just an idea I thought I would throw in as to why there seems to be empty units left untenanted. Safe haven investors aren’t the only ones leaving their units vacant.

The banks know who are the owners, local or foreign (in the cases where they have financed the debt). But they are not telling. The units bought all cash won’t even register anywhere except on the books of the vendors. That would be the domain of revenue Canada where all sales of property through developers are known….but they are not talking much either.

We might never know until someone finally turns the lights on.

–> Farmer.

“That which may be asserted without evidence, may be dismissed without evidence”

– Hitchens

Then the empty buildings shall remain one of the great mysteries of the city of Vancouver. Like how the pyramids were constructed or who made the massive pictures on the plains of Nazca that can only be appreciated from the air. Where is that astrology guy when we need him? I am sure a look into the star charts could tell us more since we all suffer behind a wall of unknowns and have mere speculation to guide us.

Are we going to get our own Zillow anytime soon?

Do we really all “suffer behind a wall of unknowns”? Absurd price-to-rent ratios. Record household debt. Falling immigration rates. History galore. It’s all in plain view.

[NoteToFarmer: JustTeasing. TeeHee! NoteToEd: TheExpert ConsensusOpinion? Stranger than fiction… worn into the very stone… in the course of a multitude’s desperate entreaties/prayer… for rain.]

“Let’s say some of these units are not actually vacant but are actually summer homes for snow birds. They’re less talked about but they make up a lot of the ‘empty condos’. I for one know four people (two in the US and two in HK) that own units in DT Vancouver for this purpose”

Ah, yes. The renowned summer mecca that is downtown Vancouver.

Tsur says move along nothing to see hear folks, empty homes are good because they pay property tax and don’t use services …….so according to him the most efficient city is one with no people

People who launder ill gotten gains are happy to maintain their capital or lose a bit………..

Carioca Canucks (His Majesty Vreaa and his loyal subjects) – speaking of ill gotten gains and how some of that money gets to Vancouver, watch this fascinating video:

http://www.theglobeandmail.com/news/british-columbia/the-great-unoccupied-condo-scandal-get-over-it/article10251782/

He almost had it, I thought he was going to say look into the mirror to see who is buying investment condos, but at least he pointed out Canadians buying in the states and how hypocritical people are about HAM buying here.

That’s a fantastic piece. Well articulated.

And….

“For instance, a 2012 analysis done for the Canadian Mortgage and Housing Corp. indicated that of the total number of condos purchased by investors the previous year – that is, people who bought but weren’t living in the units – 75 per cent were from Metro Vancouver while only 2 per cent were from foreign countries.”

Of course the CMHC would come to that result, if not only to score political points. How many foreign buyers or wealthy new immigrants require CMHC!

There is nothing says in the article that they analyzed only the condos insured by CMHC, it says “a 2012 analysis done FOR the Canadian Mortgage and Housing Corp”. The article is very weak, lack facts and when uses data, omits to state the sources of the data.

Good point BLM. There is no need for CMHC if you are above the % threshold or if you pay all in cash. That agency naturally has a blind spot where people with actual money come into the picture. If they don’t issue insurance you are NOT on their radar.

Pingback: BT | A | Works » Media and Metrics

Pingback: BT | A | Works » Media and Metrics

You really make it seem so easy together with your presentation however I in finding this matter to be really something that I feel I might by no means understand.

It sort of feels too complex and very large for me.

I’m looking ahead for your subsequent publish, I will attempt to get the grasp of it!